Referral programs leverage the power of personal recommendations, empowering satisfied customers to become brand advocates.

Businesses can tap into a trusted network of potential customers by rewarding existing customers to refer friends, family, or associates. In conversion-focused marketing, referral programs emerge as formidable tools, capitalizing on the authenticity and influence of word-of-mouth marketing. This approach amplifies customer acquisition and enhances brand credibility, creating a symbiotic relationship between customer satisfaction and business growth.

Referrals are a potent catalyst for organic growth and customer acquisition that transcends industry boundaries in banking, credit cards, and other financial services.

4 Financial Services Driving Customer Acquisition With Referral Programs.

Thanks to the convenience of online banking, individuals now have easy access to various financial institutions to find the one that best suits their needs. Despite this accessibility, people often maintain long-term relationships with their current banks, leading to fierce competition for those considering a switch.

The average lifespan of a checking account is about 17 years – and this institutional loyalty remains true across generations of consumers, including Gen Z.

One powerful way banks can entice new customers to swap financial providers is to launch a rock-solid referral program. Referrals work because they tap into that word-of-mouth power, letting existing customers share their loyalty to your company with their friends and family.

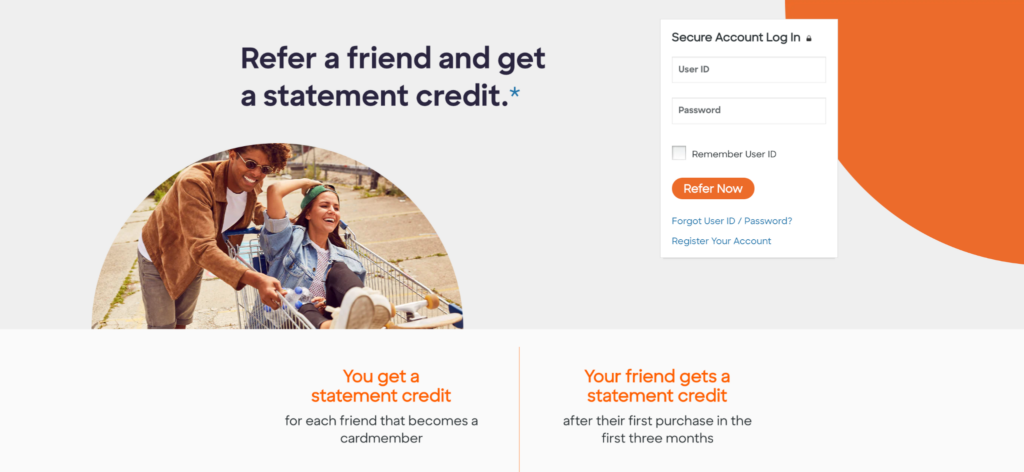

#1: Discover

Discover is a global financial services company offering reward credit cards and online banking.

Source: Discover.com

Its refer-a-friend program allows account holders to earn statement credits for each friend’s new account.

Both parties earn a $50 to $100 statement credit for each new account opened. For existing customers, the credit applies during the next billing cycle. For new customers, the credit applies after three months.

Why it works: Discover has an excellent reputation as one of the best banks in the game, thanks to its outstanding customer service. Plus, both parties get something substantial out of a referral.

The referral program landing page is also clear and informative. It offers easy-to-follow guidelines for the referral program, telling existing customers how the referral program works, and features testimonials from happy customers to reassure people that Discover provides a great experience.

#2 HSBC

HSBC is a global financial services holding company headquartered in London.

Source: us.HSBC.com

Existing customers with an HSBC Premier checking account can earn big by introducing friends and family to HSBC. An existing customer earns $300 for each qualifying referral, up to $6,000 per calendar year – the highest reward offering on our list! Plus, their referred friend earns a one-time bonus of up to $1,000.

Why it works: The caveat to HSBC’s refer-a-friend program is that the referred customer must open an HSBC Premier checking account – no other account type qualifies. A Premier checking account has a $50 monthly fee unless you meet certain criteria. Still, you get unique perks not seen in typical checking accounts, like global transfers and access to a relationship manager.

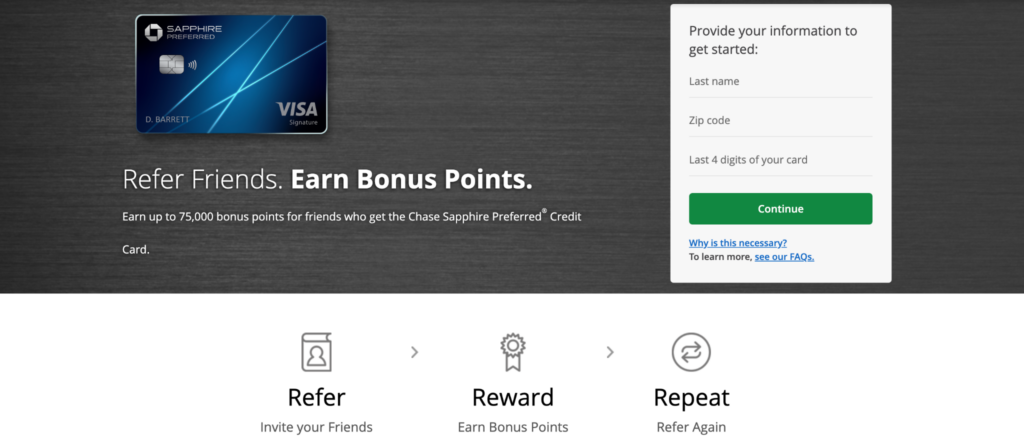

#3 Chase

Chase Bank is a national bank headquartered in New York City.

Source: Chase.com

Chase offers multiple referral programs for its different credit cards, savings, and personal checking accounts, but most of its programs are points-based.

Why it works: Many banks offer customers a points-based system for using their credit cards instead of cash bonuses.

Credit card point systems work by tapping into our brains’ psychological need for rewards. When someone is presented with a major figure, like 15,000 points, they automatically think they’re getting more of something. That’s why, instead of saying, “Refer a friend to get $160.50,” Chase says, “Get 15,000 bonus points for each friend who gets approved.”

What makes Chase stand out is the additional boost you get with one of its various rewards-based cards. Several of these cards offer specialty points that can be redeemed with major brands like Amazon, Marriott, Southwest, and Disney, to name a few. Each card has its referral program, too, with some cards offering a statement credit and others offering points.

4. Charles Schwab

Charles Schwab is a financial corporation known for its range of brokerage and retirement services.

Source: Schwab.com

When a referred friend or family member of an existing customer opens a Charles Schwab account and deposits money into it, the referred person can get up to $1,000.

Why it works: This program works for Charles Schwab because people are already willing to promote the bank, as indicated by its above-average Net Promoter Score.

One reason that the program works is that only one party gets an incentive — the new customer. Customers often hesitate when advocating for a product or service because it feels like they’re selling something, and selling to our friends feels manipulative.

With the right audience — in this case, Schwab targets investors — eliminating the referral bonus on the existing customer’s end makes it easier for customers to feel good about sharing your program.

At a Glance: Financial Services With Successful Refer-A-Friend Programs

|

You give $50 and get $50 – up to $500 per year. If you refer a friend who’s an existing customer and they open a checking account, you both receive $50. |

|

|

When a referred person opens a checking account, the original customer receives $200, and the person they referred receives $150. |

|

|

When a referred friend or family member of an existing customer opens a Charles Schwab account and deposits money into it, the referred person can get up to $1,000. |

|

|

When a new customer uses a referral link to open a new account, they earn a $25 Amazon gift card. If their account remains in good standing after 30 days, the referring customer also earns a $25 Amazon gift card – up to $500 per calendar year. |

|

|

Customers earn $50 for each friend who opens a new bank account with direct deposit. Once the direct deposit is successful, that friend also receives $50. The referring customer can make up to $1,500 per calendar year. |

Expand Your Finserv Customer Base With Referral Marketing

The Finserv market is growing at a furious pace. Leverage your advocates to capture new clients and drive more growth.

Grow Your Customer Base and Build Your Reputation with a Bank Referral Program

The best referral programs are managed with a customer-led growth marketing tool like Extole.

With Extole, you can leverage first-party data to gain deep insights into the people who already interact with your brand. Once you set up the platform, many of your day-to-day responsibilities are automated, like tracking referrals and managing payouts, freeing up time so you can focus on growing your business.

Extole’s streamlined approach empowers companies to harness the potential of referral programs and efficiently manage and optimize their strategies for sustained growth.

See Extole in action for yourself by requesting a demo!